Australia offers varied business structures; sole traders, partnerships, companies, trusts. Choosing wisely delivers tax benefits, reduced liability, investor appeal, and exit strategy. These structures, explored comprehensively, shape entrepreneurial paths. Sole traders offer simplicity but high personal liability. Partnerships entail collaboration and shared debt. Companies shield with legal distinction, yet demand compliance. Trusts provide tax advantages and trustee protection.

This article covers at length the different business structures and advantages they can offer, so business owners can make informed decisions about what is most suitable for them.

Sole trader

This is the simplest form of business structure and the least costly to set up. A sole trader is the only owner and has full control over the business. If you become a sole trader, you assume responsibility for any debts or losses. Since it’s not a separate legal entity, there’s the potential to lose your personal assets in the case of bankruptcy or potential creditor litigation against your business (yourself).

As a sole trader, you are taxed on profits at personal tax rates. So there’s a tax-free threshold of $18,200 on the income you earn as a sole trader. Also, as a sole trader, you get a 50% discount on capital gains tax (CGT) if you sell assets that have increased in value after holding them for at least 12 months. This applies to family and discretionary trusts but not companies.

Although a sole trader business structure is the easiest and least expensive to set up, it doesn’t offer the tax or liability benefits of other business structures, especially if you plan to grow the business over time. It also isn’t suitable if you want to attract investors or sell the business in the long term.

Partnership

Like a sole tradership, a partnership is not a separate legal entity. A partnership can be between 2 and 20 people who go into business together, and they can be general or limited liability, which impacts the liability of the partners. In a general partnership, each partner is jointly and severally liable for 100% of partnership debts.

Each partner pays tax based on the partnership’s profits and pays on their personal tax return, so this structure doesn’t offer tax benefits as a company or trust can. However, an annual partnership tax return must be filed, including the partnership’s income and expenses. Also, the partners have personal liability for any debts the partnership owes.

A key point of setting up a partnership is creating a partnership agreement. This can help to avoid future disagreements by outlining the partner roles, what is expected and an operational overview. It can also include the conditions and process for dissolving the partnership. Two of the biggest downsides of partnerships are the potential for disagreements between partners and the difficulty of adding or removing partners.

This structure can work when two trusts or companies operate together. It’s not suitable for two sole traders to run a partnership, as it has unlimited liability for all partners. Considering the benefits of other structures, a partnership is the least preferable.

Company

One of the big advantages of the company structure (proprietary limited) is that it’s a separate legal entity, so shareholders are not personally liable for the company’s debts. Any successful claim against the business will be paid out through the company’s assets and cash reserves.

Another advantage of a company structure over a sole tradership or partnership is the tax rate. For base rate entities (below the income threshold of $50 million aggregated turnover), there is a flat tax rate of 25% on profits (30% for companies earning with over $50 million annual revenue). In comparison, the highest marginal income rate for sole traders and partners is 45%. In addition, companies can offset the tax losses from one company against profits made by another. There’s also the potential to carry losses forward from the past into more profitable future years.

A company structure appeals to investors due to limited liability and tradable shares. All company details must remain current on the public ASIC register. As a legal entity, a company persists until dissolution, allowing succession planning for shareholder or director changes.

On the downside, there are higher set-up and admin costs and compliance requirements associated with starting a company. Company directors need to be active in the business and understand their legal obligations and compliance requirements to avoid liability for breaching duties.

Despite these requirements, sole traders can benefit from starting a company if they want a lower tax rate and want to attract investors and scale.

Family and Discretionary Trust

A trust can provide tax advantages, flexibility and liability protection. A discretionary trust enables a person or the persons managing the trust to choose the trust beneficiaries and the percentage of the trust distribution they will receive. For example, if there are two people in the trust, it doesn’t have to be divided 50/50. One beneficiary could receive 90% and the other 10% to minimise their tax obligations (based on their marginal tax rates).

Family trusts are discretionary trusts used to hold a family’s assets, including a family business. One or more family members can manage the trust for the entire family. The trustee or trustees determine the benefits for family members.

A trust is created using a legal document called a trust deed which outlines the terms, rules and conditions for creating and managing the trust.

One of the advantages of a discretionary trust is that it enables a person to hold assets without being the legal property owner. If a creditor pursues a beneficiary’s assets, they are usually protected because the trustee legally owns the asset and not the beneficiary.

Unlike a company, a discretionary trust does not have to pay income tax. Instead, the trust beneficiaries pay tax on their share of the trust income when they pay personal income tax (at their marginal tax rate). In a family trust, the trustee can distribute assets to family members to minimise the overall tax paid by the family.

On the downside, there are costs associated with setting up a trust, and the trustee can be liable for debts (unless the trustee is a company). Also, trusts are not set up to attract investors and are not designed to keep profits beyond the financial year. If the beneficiaries don’t receive the trust’s profit each year, the trust will be taxed heavily at top marginal tax rates.

Using a holding company with trust

This can be used to defer tax and further protect against personal liability. One potential scenario with this structure is to have a family trust own 100% of a holding company (Pty Ltd). The holding company can own operating businesses beneath it. The holding company – which doesn’t trade as a business – owns shares in the operating businesses. Profits from the operating businesses are paid into the holding company, where the cash can accumulate.

Because excess cash accumulates in the holding company, the assets of the operating business are protected. This also allows profits to be retained – which is not possible with a trust by itself – to grow the business and fund working capital. When dividends are paid out, they will represent income for the trust in the year the dividend was paid. This can then be allocated to beneficiaries on a discretionary basis.

Choosing the right business structure

With several types of business structures available, you need to consider the pros and cons of each one, whether you’re setting up your new business or changing the structure of your existing one.

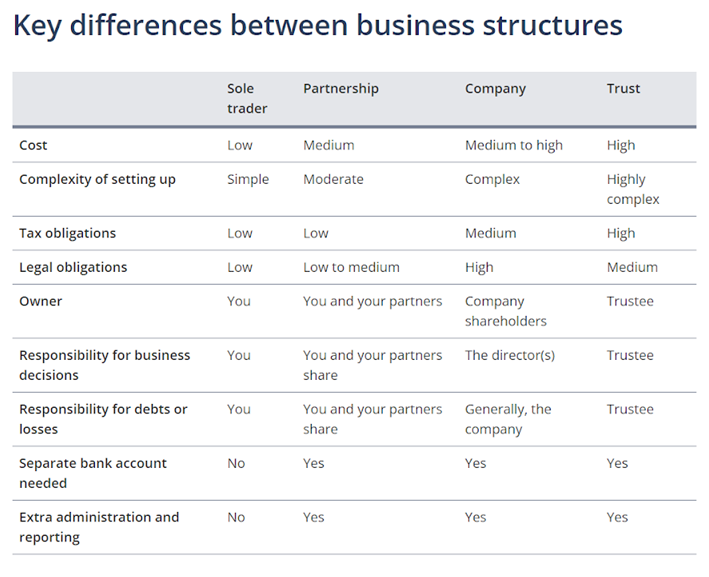

Here’s an overview of some of the key differences between business structures.

At Equil Advisory, we can help you understand the big picture and choose the best structure for your current and future needs. As experts in this area, we work with business owners at all stages, reviewing their structure in line with their personal circumstances and long-term objectives.

Get in touch with a member of our expert team to review your current business structure or discuss the potential benefits of changing to a different business structure.